The Price Is Not Right

The July 2025 Rightmove House Price Index illustrates the intertwined relationship of variable factors in the UK property market. On the one hand, average asking prices are falling - driven largely by an increase in available properties, giving buyers more choice and negotiating power.

On the other hand, this downward pressure is being counterbalanced by a rise in buyer enquiries and a solid volume of agreed sales. Fuller Gilbert take an objective look at the latest report and explore what its findings could mean for the market in the months ahead.

Come On Down

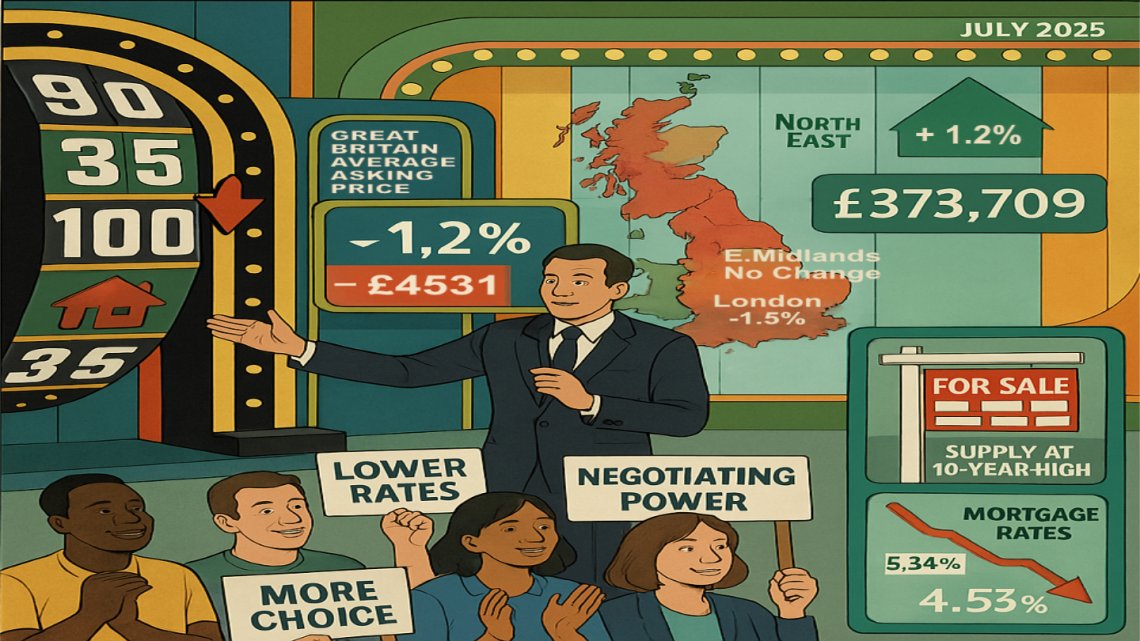

In a notable shift, average asking prices for newly listed homes across Great Britain dropped by 1.2% (£4,531) in July, falling to £373,709. This marks the steepest July decline since Rightmove began tracking over 20 years ago. While seasonal dips are typical for this time of year, this drop stands out for its scale.

London Dip

London saw the most significant regional fall, with prices down 1.5%, driven by a sharp 2.1% drop in Inner London. Several factors are contributing to this trend:

- Stamp duty changes introduced in April are impacting high-value properties.

- Earlier surcharges on second homes continue to weigh on investor sentiment.

- Tax concerns around non-domiciled status are dampening demand in prime areas.

Regional Market Contrasts

Outside the capital, the picture is more mixed:

- North East: Up 1.2%, reflecting continued strength in more affordable regions.

- North West & South West: Minor declines.

- East Midlands: Prices remained flat.

This divergence highlights how affordability and local dynamics are shaping regional resilience.

Supply Surge Driving Price Sensitivity

The number of homes for sale has reached a 10-year high, intensifying competition. Buyers now have more choice and are increasingly price-sensitive. As Rightmove’s Colleen Babcock notes, “The price is key to selling”—overpriced listings are quickly overlooked.

Buyer Demand Remains Resilient

Despite falling prices, buyer activity is holding firm:

- Agent enquiries are up 6% year-on-year

- Sales agreed are up 5%, marking the strongest mid-summer performance since 2021

Lower asking prices are drawing buyers back into the market, sustaining momentum.

- Sales Agreed are up 5% making this the strongest mid-summer performance since 2021

Mortgage Rates & Affordability Trends

Affordability is improving:

- Two-year fixed mortgage rates have dropped from 5.34% to 4.53% over the past year—saving buyers nearly £150/month on a typical mortgage.

- Some lenders now offer two- and five-year fixes below 4%, anticipating further Bank Rate cuts.

With average earnings up over 5% and asking prices just 0.1% higher than last year, real affordability is on the rise.

Revised Forecasts & Market Outlook

Rightmove has revised its 2025 asking price growth forecast from +4% to +2%, citing increased supply and cautious buyer behaviour. However, they still expect around 1.15 million transactions this year and remain optimistic about the second half of 2025 - especially if interest rates continue to fall.

What This Means for Buyers & Sellers

For Buyers

- Greater negotiating power: More supply means better deals.

- Improved affordability: Lower mortgage rates and rising wages help monthly budgets.

- Seasonal opportunity: July’s slower pace can offer hidden value.

For Sellers

- Price realistically: Overpricing risks stagnation.

- Stand out with presentation: Sharp pricing and well-staged homes are key.

- Stay patient: Buyer demand is strong - at the right price point.

- A well staged home and sharp pricing could be key in the current climate

Looking Ahead

- Interest rate cuts expected: A 0.25% cut is likely on August 7, with up to two more by year-end.

- Prices may stabilise or rebound: July’s dip could mark the bottom.

- Regional divergence to continue: London may lag, while affordable areas like the North East and Scotland could outperform.

- Policy watch: London remains sensitive to stamp duty, non-dom rules, and rental regulations - any changes could impact investor demand.

- More interest rate cuts are anticipated this year

Summary

July’s record price drop - especially in Inner London - reflects both seasonal trends and deeper market shifts. With supply at decade highs and affordability improving, buyers are in a strong position. Sellers must adapt with realistic pricing and standout presentation. While Rightmove’s forecast signals caution, the outlook remains positive for the latter half of 2025, particularly in regions with stronger affordability.

This article is for informational purposes. Always seek professional advice before making any property decisions.