Transition or Exodus?

London has long been a cornerstone of international real estate investment. Its combination of legal stability, global connectivity, and financial infrastructure has historically attracted overseas capital in significant volumes. However, emerging data and market sentiment suggest that investor behaviour may be evolving.

Rather than a dramatic retreat, this shift could simply be the reflection of a broader recalibration in response to changing regulatory, fiscal, and economic conditions. What does this mean for the capital, and how should stakeholders interpret these developments?

A New Investment Environment

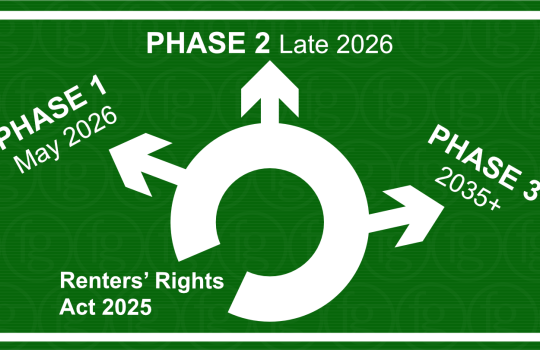

Recent changes to the UK property investment landscape have been significant. A 2% stamp duty land tax (SDLT) surcharge on non-UK buyers - on top of existing tiered SDLT rates - has increased acquisition costs for foreign investors. Meanwhile, regulatory reforms such as the Renters’ Reform Bill aim to overhaul the rental market, with proposals to end “no-fault” evictions and introduce new obligations for landlords.

These interventions are designed to protect tenants and foster a fairer housing system. However, from an investor perspective - particularly international buyers accustomed to lower-regulation markets - they introduce new layers of complexity, cost, and perceived risk.

While some view this as a deterrent, others see it as the beginning of a more transparent and accountable investment environment. Institutional investors with ESG (environmental, social, and governance) mandates or long-term strategies may actually view regulatory maturity as a strength rather than a weakness.

Redirection, Not Retreat

Rather than representing a wholesale retreat, current trends suggest a redistribution of capital. Markets such as Lisbon, Dubai, and Berlin have seen increased interest, often due to a combination of lower entry costs, favourable tax regimes, and comparatively relaxed regulation.

However, London’s fundamentals remain strong. It continues to offer deep market liquidity, strong legal protections, and a unique combination of cultural, educational, and business infrastructure. These factors maintain its appeal for certain investor profiles, particularly those prioritising asset security over short-term yield.

Moreover, London’s status as a ‘safe haven’ market has historically reasserted itself during times of global volatility - something that may remain relevant in light of macroeconomic uncertainties and geopolitical instability.

The Local Opportunity

One of the immediate effects of this cooling in overseas interest is an uptick in activity among UK-based buyers. According to recent reporting in the Financial Times, domestic families and investors are taking advantage of reduced competition and price corrections - particularly in prime postcodes. Some high-end properties are reportedly changing hands at significantly discounted rates, compared to peak valuations.

This window may be short-lived but is indicative of a more accessible environment for local capital. Even if first-time buyers remain largely priced out of luxury segments, mid-market investors and landlords could benefit from improved access and slightly less upward price pressure in adjacent markets.

Regulation: Risk or Long-Term Strength?

For all the debate around government intervention, there is a case to be made for the long-term benefit of a more structured market. Improved tenant protections, enhanced transparency, and a clearer legal framework could reduce operational risks and support the professionalisation of the landlord sector.

What concerns investors most, however, is not regulation itself - but inconsistency. Frequent policy changes or vague proposals create uncertainty, making it harder for long-term investors to assess risk and deploy capital with confidence.

Short-Term Headwinds, Long-Term Realignment

While a temporary slowdown in international capital could promote domestic participation, it also has wider economic implications. Reduced demand for high-end developments may delay projects or impact job creation in construction and real estate services.

That said, a period of recalibration could ultimately produce a more stable, diversified, and sustainable market. The focus, therefore, should be on managing the transition - minimising disruption while encouraging long-term, responsible investment.

Balancing Reform with Investment Appeal

To ensure London remains globally competitive while pursuing housing reform, policymakers and industry leaders might consider:

- Targeted Tax Incentives

Relief for long-term or socially responsible investment could encourage stable capital flows. - Regulatory Clarity

Establishing a predictable legislative roadmap would reduce investor uncertainty. - Differentiated Regulation

A more nuanced approach that distinguishes between institutional landlords and speculative investors could ensure fair treatment.* - Promoting UK-Wide Investment

Proactively guiding foreign capital toward regional markets could drive regeneration outside of London and ease demand pressures in the capital.

A Market in Strategic Transition

It could therefore be perceived that rather than being in decline, London's property market is in transition. The apparent cooling of international interest should perhaps be seen less as a warning sign and more as a signal that the city is entering a new investment phase.

Investors, policymakers, and developers alike will need to navigate this new terrain thoughtfully. If regulation is balanced with investment incentives, London can continue to serve as a world-class property market - albeit one that is more measured, inclusive, and strategically aligned for the long term.

*Institutional investors and their benefit to the property lettings market is subjective to say the least. FG will look at this in a future article.