Smart Contracts Demystified

Blockchain technology has been touted as a game-changer for property transactions. Faster completions, automated payments, and “self-executing” agreements promise to streamline a UK conveyancing system often criticised for being slow, complex, and paper-heavy.

But how much of this vision is achievable today? And how much remains experimental, theoretical - or simply misunderstood?

For UK homebuyers, sellers, and property investors, the reality of blockchain-based smart contracts sits somewhere between genuine legal possibility and early-stage innovation. The foundations exist - but widespread adoption is still some distance away.

Fuller Gilbert takes a closer look, as we continue our exploration of the evolving digital landscape in the property market.

What Do We Mean by “Smart Contracts” in UK Property?

A smart contract, at its simplest, is computer code that automatically executes actions once certain conditions are met. On a blockchain, that might mean releasing funds, recording an event, or triggering another digital process without human intervention.

In legal terms, the more relevant concept is the smart legal contract - a contract that uses code to perform or support parts of a legally binding agreement. It does not replace law; it complements it.

Under English law, there is nothing inherently invalid about this approach. A contract does not need to be on paper - or even in traditional language - to be enforceable. What matters is that the essential elements of contract formation are present: offer, acceptance, intention to create legal relations, consideration, and sufficiently certain terms.

This position was confirmed by the UK Law Commission and the UK Jurisdiction Taskforce: the law of England and Wales is flexible enough to recognise smart legal contracts without new legislation. In short, code can support enforceable agreements - but it doesn’t replace lawyers.

Has Blockchain Actually Been Used in UK Property Transactions?

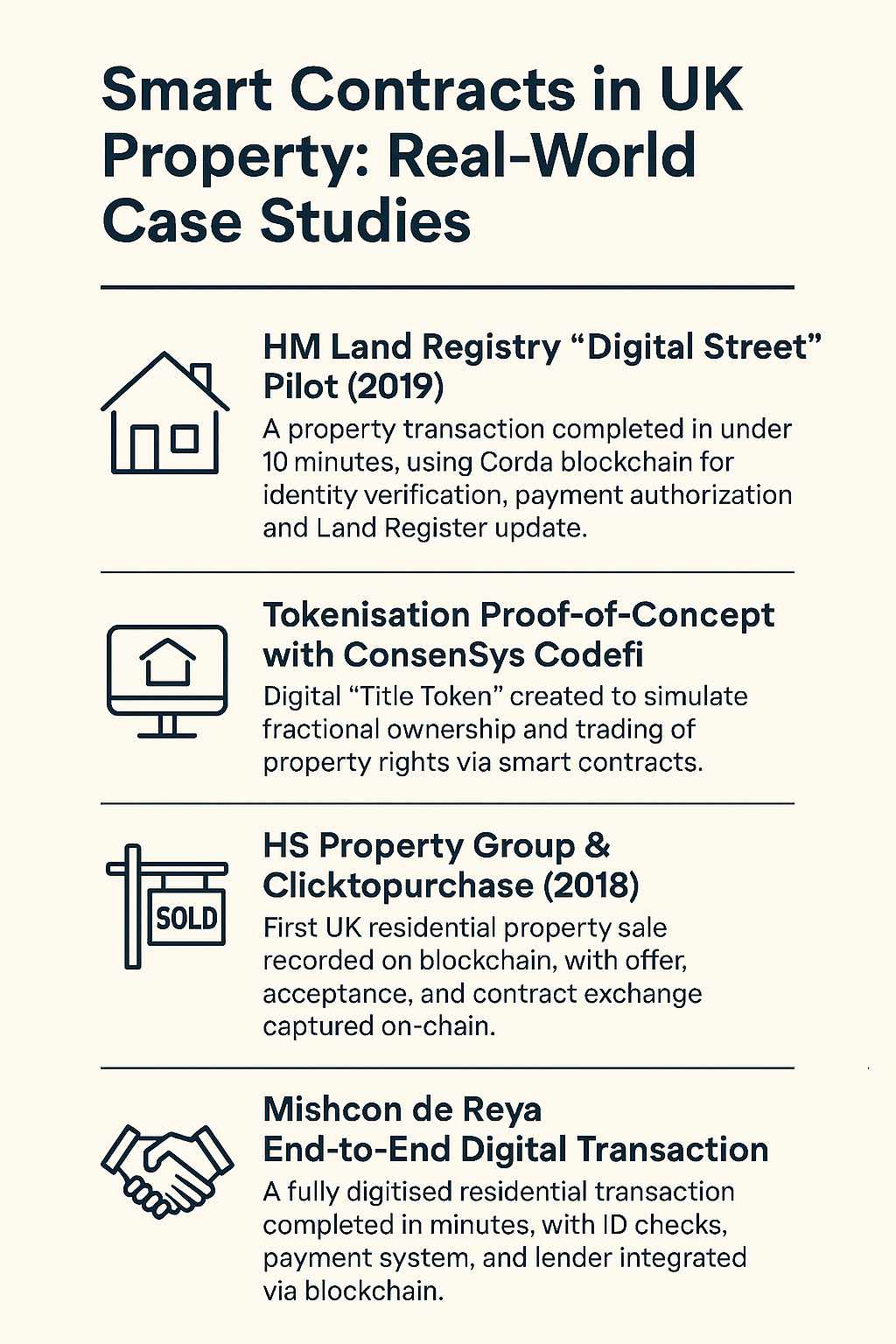

Yes - but only in limited, highly controlled circumstances.

There have been small-scale, publicly reported transactions where blockchain technology featured in the conveyancing process. These were typically pilot projects using permissioned (access-controlled) systems, with close coordination between legal professionals, technology providers, and HM Land Registry.

Such examples prove that blockchain-enabled workflows can integrate into UK property transactions. But they remain the exception, not the rule.

The UK is not a jurisdiction where blockchain fills a regulatory vacuum. Property ownership is governed by a mature, centralised system - most notably HM Land Registry - and a structured conveyancing profession. Any meaningful shift toward blockchain-based conveyancing must operate alongside, or be adopted by, these institutions rather than replacing them.

Why Blockchain Hasn’t Gone Mainstream in UK Conveyancing

Despite legal permissibility, several practical barriers remain:

- No universal technical standard: Without agreed protocols, blockchain-based conveyancing risks fragmentation.

- Complexity of transactions: Property deals involve due diligence, inspections, title investigations, lender requirements, and professional judgment—steps that don’t lend themselves easily to rigid automation.

- Institutional adoption: Large-scale change requires endorsement from HM Land Registry, major lenders, and leading conveyancing firms. So far, uptake remains limited to pilots.

For now, blockchain use in UK property sits firmly in the realm of proofs of concept and niche transactions.

| Feature - scroll to continue with content... |

| continue reading article... |

The Reality of Smart Contracts: Hybrid, Not Fully Automated

A common misconception is that smart contracts will replace traditional legal documents entirely. In practice, the opposite is more likely.

Most smart legal contracts in property will be hybrid arrangements: a conventional written contract sets out rights, obligations, and remedies, while selected elements - such as conditional payments or status confirmations - are automated through code.

This reflects legal and practical reality. Property agreements often involve discretion and contingencies that are hard to express in code. Courts interpret contracts based on context and intention - something pure logic cannot capture.

Smart contracts should therefore be seen as tools to assist performance, not replacements for legal agreements or professional oversight.

What the Law Currently Supports - and What It Doesn’t

The UK legal framework supports smart legal contracts in principle. Automated performance does not undermine enforceability, and digital systems can coexist with established doctrines of contract law.

However, unresolved questions remain:

- How will courts interpret code-based terms in disputes?

- How will errors in automated execution be addressed?

- What happens when systems operate across borders or platforms?

Separately, the legal status of digital assets has advanced. The Property (Digital Assets etc) Act 2025, which received Royal Assent in December 2025, confirms that digital assets - such as crypto tokens and NFTs (Non-Fungible Tokens) - can be recognised as property under English law. This strengthens the foundation for tokenisation and digital ownership structures.

But crucially: it does not convert land into a purely digital asset. Real-world property remains subject to land law, planning law, and statutory protections that technology cannot bypass.

| Feature - scroll to continue with content... |

| continue reading article... |

What This Means for Buyers, Sellers, and Investors

For most people involved in ordinary residential transactions, blockchain-based smart contracts are not yet something to expect or rely upon. Conveyancing remains a human-led, document-driven process, with digital tools used mainly to support - not replace - existing practices.

That said, smart contracts may already offer value in certain contexts: complex transactions, bespoke agreements, cross-border investments, or situations where speed and conditional automation matter. In those cases, they are most likely to appear as part of a carefully structured hybrid model, supported by traditional legal documentation and advice.

Anyone engaging with blockchain-enabled property transactions should proceed cautiously, ensure clarity on jurisdiction and dispute resolution, and seek proper legal advice - just as they would with any non-standard arrangement.

Summary: Solid Foundations, Slow Transformation

Blockchain and smart contracts are not incompatible with the UK property market. On the contrary, the legal foundations are sound, and early experiments show that automation can play a useful role.

But transformation will be gradual, cautious, and incremental. Land law, regulation, and institutional trust mean change will not be sudden or revolutionary.

For now, smart contracts in UK property are best seen not as a replacement for conveyancing - but as emerging tools that may, over time, make it more efficient, transparent, and resilient.

For most buyers and sellers today, they remain something to watch - rather than something you can expect to use.

This article is for informational purposes. Always seek professional advice before making any property decisions.